Spotlight on Undervalued Gold, Silver, and Mining/Exploration Companies

OTC focus: We're zeroing in on true over-the-counter stocks like pink sheets and OTCQB, avoiding listed exchanges for high-volatility penny potential.

Gold hits $3,500+ highs: Driving interest in explorers with near-term catalysts, where small caps can double on drill news or acquisitions.

Silver surges to $40+: Industrial demand boosts producers and developers, with supply deficits amplifying upside.

Risk alert: These are speculative; 100% gains in 4 weeks hinge on catalysts like assays or partnerships, but losses can be swift.

Top pick revealed: One stands out above all the rest—details below.

Market buzz: X chatter highlights undervalued OTC names with drilling results imminent, setting up breakout potential.

With gold and silver shining bright in September 2025, OTC mining stocks offer lottery-ticket leverage for aggressive traders. These under-the-radar plays trade off major exchanges, often with low floats and high beta to metal prices. I scoured and sleuthed for gold/silver-focused names with catalysts that could spark 100%+ moves in the next 4 weeks—think drill results, resource updates, white house initiatives and M&A whispers. Here's the landscape and our bold speculations. Buckle up; this is high-risk territory, but the rewards? Potentially life-changing.

$BMXI: Our Pick for Big Mining Gains

Why? It's a producing gold miner with real revenue ($20M+ annualized), undervalued at 0.1x book, and catalysts stacking: Debt payoff complete by Q4 (still watching for dilution to create buying opportunity in Q3), uplist to NASDAQ, and $500K buyback. Gold and silver at record highs boosts margins 50%+, and market sentiment screams "load up" for a quick double that might not look back.

Target: $0.04+ in 4 weeks on news flow—100% gain to potentially double your trade every month. High risk? Absolutely, but history shows pennies like this rocket 200-500% on metal hype alone (e.g., 2020 silver squeeze). Diversify elsewhere, but for pure speculation, $BMXI shines.

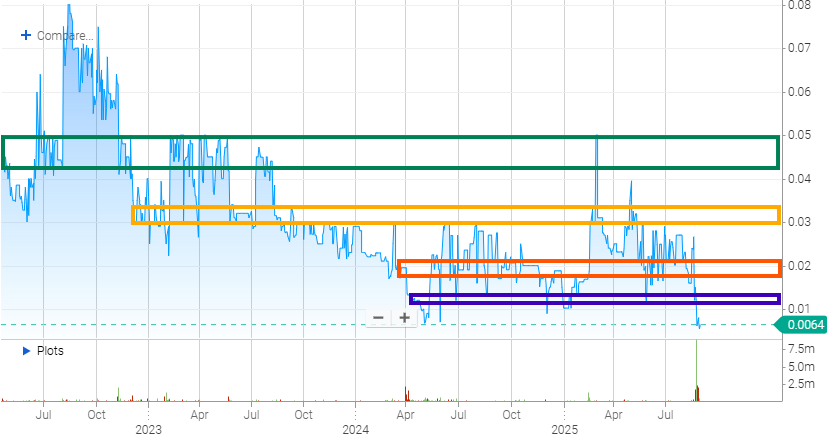

Green is going to be our maximum resistance area, but it’s possible we make it back to the yellow and accumulate at levels well above $0.10 cents… when you expand your time horizon, this chart shows big mover potential over the next few months.

Uncovering $BMXI: Deep Dive Into A Gold Explorer with Revenue Momentum and Uplist Potential

Brookmount Explorations Inc., trading as $BMXI, is focused on gold exploration and production, primarily in regions like the Yukon and Peru. The company has shown revenue growth in recent quarters, reporting sales jumps and plans for diversification. But let's zoom in on the financial nuts and bolts that could impact your investment.

Debt Structure and Convertible Risks

$BMXI maintains a relatively modest debt profile, with total debt standing at approximately $878,000 as of the most recent quarter. This equates to a low debt-to-equity ratio of about 1.78%, suggesting the company isn't overly leveraged. Key to watch: The company has mentioned remaining convertible debt, which it's actively working to pay down using a new $2 million credit facility from J.J. Astor and Co. This facility, announced in June 2025, aims to restructure obligations and support expansion, potentially reducing conversion risks that could flood the market with new shares.

Convertible notes have been part of $BMXI's financing history – for instance, older filings reference notes convertible into hundreds of thousands of shares. However, with cash flow priorities shifted toward debt repayment, the dilution threat appears contained for now. Total liabilities hover around $1.47 million, balanced against shareholder equity of about $54 million, painting a picture of financial stability in a risky sector.

Share Structure Breakdown

$BMXI's share setup is straightforward but expansive. Outstanding shares total 216.48 million, with a float of 164.22 million providing decent liquidity for an OTC stock. Insider holdings are minimal at 0.44%, and institutions are absent at 0%, meaning retail investors drive most of the action. Authorized shares are a whopping 2 billion based on historical filings, though the company has filed to reduce this number in recent years to curb potential overuse.

Recent moves include a stock buyback authorization for up to 10 million shares (capped at $500,000), which could help stabilize the price by reducing supply. Overall, while the high authorized count leaves room for future issuances, $BMXI's structure doesn't scream immediate dilution danger – especially with ongoing revenue to fund operations.

Speculation on $BMXI's Bottom Price

Looking at the charts, $BMXI has traded in a 52-week range of $0.006 to $0.082, with recent action around $0.024. Historical bottoms cluster around $0.017-$0.020, but the absolute low hit $0.006 in June 2025 amid broader market dips. Given the company's positive equity ($54M) against a market cap of just $5M, there's a clear value disconnect – book value per share sits around $0.25.

For a patient trader, a good entry at real value discount could (hopefully) be around $0.015. This level factors in potential short-term volatility from mining risks but offers upside if gold prices rally and debt cleanup continues. It's a speculative bet, but one backed by fundamentals rather than hype.

The OTC Gold & Silver Scene: Volatility Meets Opportunity

OTC mining stocks thrive on speculation, with many under $1 sporting massive upside if metals rally further. Gold's record run (up 20% YTD) stems from inflation hedges and central bank buying, while silver's 25% gain ties to solar/EV demand. Key OTC players include $PSGR, explorers like $GGLDF (GoldMining Inc.) with multi-million-ounce resources and $AYASF (Aya Gold & Silver) as a top performer. Others like $SDRC (Silver Dragon Resources) and $EXNRF (Excellon Resources) offer silver exposure but lag on catalysts.

Recent catalysts? The white house has a huge rare earth elements and mining initiatives coming out from the top brass of our nation. Junior news flows highlight resource expansions and drills—e.g., Austral Gold's loan for ops, or broader sector M&A. Market sentiment echoes this, with calls for breakouts in undervalued names amid rising prices.

Debt and Share Structures: Dilution Risks in Focus

OTC miners often fund via equity, so we’re always on the watch for convertibles and shares issuances:

Low-debt winner: $GGLDF boasts clean finances, with no major convertibles noted; outstanding shares ~250M, authorized ample but no immediate dilution flags. Also price has gone up dramatically, so swingers may want to wait on a pullback in price for safer entry. (We discourage buying green candles…)

Silver plays: $AYASF has modest debt, and still watch for raises; ~100M outstanding, float ~80M for liquidity.

Riskier setups: Names like $BBBXF (Brixton Metals) show higher authorized vs. outstanding, signaling potential issuances.

But there’s one chart that is looking super spicey…

Our 2nd Pick: $PSGR, Speculating 100%+ in 4 Weeks.

“No matter how you slice it, chart looks like a nice win over the next few months, especially if dilution dries up and prospects start looking up.”

Pershing Resources ($PSGR) Stock: Penny Miner Eyes Turnaround Amid Gold Boom

Pershing Resources Company Inc. (OTC: $PSGR), a junior mining firm based in Reno, Nevada, focuses on exploring gold, silver, and copper. As gold prices hit record highs, this penny stock could offer high-risk, high-reward potential for investors hunting undervalued miners.

What Is Pershing Resources?

Founded in 1996, $PSGR targets mineral deposits in Arizona and Nevada's rich mining districts. Its key asset, the New Enterprise Project, covers over 3,600 acres in Arizona's Laramide porphyry copper belt. This includes historic sites like the Enterprise and Century Mines. The company has expanded with more than 2,000 additional acres and recent moves, such as a 2024 acquisition deal and adding exploration experts to its team.

Still in the exploration phase, $PSGR has no revenue yet. It relies on drilling results to build value, making it a super-speculative bet in the mining sector.

$PSGR Stock Performance: A 5-Year Roller Coaster

Over the last five years (2020-2025), PSGR shares have swung wildly, typical for penny stocks. Prices ranged from a low of about $0.0027 to a high of $0.0526.

2023 Snapshot: Monthly prices bounced between $0.02 and $0.05. February saw a 66% jump with over 3 million shares traded.

2024 Trends: Shares stayed steady at $0.016-$0.027, showing quieter trading.

2025 So Far: Early spikes hit $0.05 in February-March, but prices fell to $0.005-$0.006 by August amid market dips. Crazy volatility such as this is not for the faint of heart.

The stock hit 10 new highs but also 7 new lows, highlighting its swing potential and underscoring the inherent opportunity held within the structure.

What If $PSGR Reverses From These Lows? A Speculative Outlook

Imagine $PSGR flipping its script from 2020-2021 lows around $0.01-$0.02. Riding the gold rally and strong drilling news, shares could have doubled or tripled like peers.

Round one: Climb to $0.06-$0.08 on resource updates.

Potential Gains: Could it reach $0.10-$0.15 with gold above $2,000 per ounce and exploration hype?

Sector Surge: Political narratives could help break through yearly macro resistance, hitting $0.20 or more on fresh business results and potentially delivering 10x returns over the coming months.

This "what-if" assumes perfect timing, no funding issues, and bullish markets. In reality, junior miners like $PSGR face risks from dilution and delays. Upcoming assays could spark a real breakout, but investors should do their homework.

Disclosure: This is not investment advice. Penny stocks involve high risk. Consult a financial advisor.

More Diligence Buried deep in digital space…

Deep Dive Journal: Analyzing Mining Stocks $COPR and $AMNP – Debt, Shares, and Risks vs. Rewards

$COPR exhibits minimal debt as an exploration-stage company, with no outstanding convertible obligations noted in recent filings, reducing dilution risks.

$AMNP has a history of convertible promissory notes, potentially leading to share dilution upon conversion, alongside recent share issuances for acquisitions.

Both companies feature large authorized share capacities typical for juniors, with $COPR at unlimited common shares and $AMNP showing high outstanding counts.

$COPR's share structure includes 177.3 million outstanding shares and a fully diluted count of 219.8 million, reflecting warrants and options.

$AMNP boasts 878.6 million outstanding shares, with a public float of 546.6 million, indicating significant restricted holdings.

Speculative bottoms point to value entries amid volatility, with $COPR potentially at $0.15 and $AMNP at $0.01 for patient investors.

Exploring $COPR: Copper Hunter in South America

Coppernico Metals Inc., or $COPR, zeros in on copper-gold exploration in Peru, with its flagship Sombrero project spanning vast hectares in a mineral-rich belt. As a pre-production entity, it's all about unlocking value through discoveries, buoyed by copper's role in EVs and renewables.

Debt Structure and Convertible Risks

$COPR runs lean on debt, typical for early-stage explorers relying on equity raises. Recent filings show no long-term debt or convertible notes outstanding, with liquidity managed via cash from financings. A $19.37 million equity financing in 2025, including a strategic stake from Teck Resources, bolsters its balance sheet without adding leverage. Total liabilities are minimal, around working capital needs, with no derivative or convertible obligations that could dilute shares via conversions.

Cash reserves from the raise support drilling without immediate debt pressure, though future needs could arise if discoveries demand capital. Equity focus keeps dilution risks low for now—no "toxic" convertibles in sight.

Share Structure Breakdown

$COPR has 177.3 million shares outstanding, with unlimited authorized common shares—a common setup for TSX-listed firms to enable flexible raises. Warrants total 36.1 million (mostly at $0.30, expiring 2029), and options stand at 6.3 million, pushing fully diluted to 219.8 million. Restricted shares aren't detailed, but insider and strategic holdings (e.g., Teck's 12-month lockup on new shares) suggest some limits on immediate float.

The structure supports growth funding but warrants vigilance on warrant exercises, which could add shares if prices climb.

Speculation on $COPR's Bottom Price

$COPR's 52-week range sits at $0.18 to $0.32, with recent trading around $0.25. Historical lows hover near $0.20, but volatility in juniors could test $0.15 amid broader market dips. At that level, with a market cap under $27 million against Peru's copper upside, it offers a real value discount—ideal for patient traders betting on exploration hits.

Uncovering $AMNP: Precious Metals Explorer

American Sierra Gold Corp., trading as $AMNP, pursues gold and silver acquisitions, recently adding the Q'Inti project via share issuance. As an OTC player, it's speculative, focusing on eco-friendly methods and community ties.

Debt Structure and Convertible Risks

$AMNP has leaned on convertible promissory notes historically, posing dilution risks as they convert into shares at potentially discounted rates. Older filings note such instruments for funding, with conversions tied to stock performance. Recent activity includes debt-to-equity swaps, like issuing 400 million shares for property acquisition in 2024. Total debt isn't quantified in latest overviews, but as a micro-cap, it's likely modest yet impactful if converted.

This setup heightens dilution watch—conversions could flood the market, pressuring price.

Share Structure Breakdown

With 878.6 million outstanding shares and a public float of 546.6 million, $AMNP implies significant restricted holdings (about 332 million). Authorized shares aren't specified, but the high count suggests ample room for raises. Recent issuances for assets underscore an expansive structure, common in OTC miners but a red flag for per-share value erosion.

Speculation on $AMNP's Bottom Price

Trading near $0.03 with a 52-week range of $0.00 to $0.03, $AMNP shows thin liquidity and volatility. Support levels are elusive, but a patient entry at $0.01 could capture upside if projects advance, offering a steep discount on speculative precious metals exposure.

Both $COPR and $AMNP suit risk-tolerant investors chasing mining booms who want to further diversify the portfolio. $COPR edges out for stability, while $AMNP appeals for high-flyer potential. DYOR, track commodity trends, and consider diversification per our analysis at this time.

What’s your take? Are Explorers set to win big in September?

Disclaimer: All content is for educational and entertainment purposes only. It is not intended to be, and should not be construed as, financial advice, investment recommendations, or any form of professional guidance. Investing in stocks, mining companies, or any financial instruments involves significant risk, including the potential loss of principal. Past performance is not indicative of future results. Always conduct your own research and consult with a qualified financial advisor or licensed professional before making any investment decisions. The author and publisher disclaim any liability for losses incurred as a result of using or relying on this information. Viewer discretion is advised.